Scale Your Net Worth By Starting A FREE

Virtual Law & Tax Consulting Firm

100% Online, Recession-Proof, And Lucrative.

We Will Fund Your Launch:

100% Risk-Free Online Entrepreneurship

We have the tools, technologies, and support staff to help you launch & grow with us!

We are a software & consulting firm

My name is Sid Peddinti - nice to meet you. I'm a TEDx Speaker, Legal Innovator, and Estate & Tax Lawyer.

In 2001, I started a bakery after getting inspired by "Rich Dad". It was an extremely successful venture and we crossed the 7-figure sales mark very quickly.

However, in 2005, the banks forced me to shut down and flushed me clean - I went bankrupt at 22, a few months after graduating university. Dreams flushed down the drain in the snap of a finger.

I embarked on a mission to learn and master Law & Tax concepts and teach other entrepreneurs and investors how to avoid my mistakes.

Over the past two decades, I've worked with tens of thousands of people and have restructured billions in assets and reduced billions in taxes & high-interest debts for families across Canada and the US.

I have partnered with hundreds of professionals in different industries who were looking to stand-out in their marketplace, add more value to their clients, and increase their bottom-line in a risk-free manner.

I build online law and tax firms for my joint venture partners and teach them how to increase client retention rates, increase transaction value, and increase profit margins by doing two simple things:

1. Forming a joint venture with me

2. Launching a virtual law and tax consulting firm

3. Having conversations with existing or new clients on these topics

Every single client that you work with needs estate and tax planning, at one point or another. The more their net worth, the more important the need for robust and ongoing estate and tax planning becomes - and that's what my firm, Law & Tax Consulting, offers for clients.

We handle the entire back-end work: creating a website, managing it, managing the calendar and booking systems, sales calls with customers, conversions, payment processing, evaluations, drafting, filing, and ongoing legal and tax support for clients.

We need "trusted advisors" who

We will teach you the basics, enough to facilitate highly intelligent conversations around these topics, and provide resources to collect and direct clients to us.

No Setup Cost. No Ongoing Cost. No Hidden Cost.

100% FREE - It's On Us!

We will build it for you and help you run it

Every single clients needs it

It can be stand-alone or blended in

It is easy-to-setup and manage

Tap into a high-demand service

Attract multi-millionaire clients

Stand out from your competitors

Become more recession-proof

Increase client loyalty and trust

Here are the types of firms that can offer this:

Lawyers and law firms

Accountants & tax professionals

Financial & investment advisors

Insurance professionals

Real estate professionals

Investors and fund advisors

Business consultants & coaches

Marketing agencies & consulting firms

Reasons to offer estate & tax consulting:

Every single clients needs it

It can be stand-alone or blended in

It is easy-to-setup and manage

Tap into a high-demand service

Attract multi-millionaire clients

Stand out from your competitors

Become more recession-proof

Increase client loyalty and trust

Here are the types of firms that can offer this:

Lawyers and law firms

Accountants & tax professionals

Financial & investment advisors

Insurance professionals

Real estate professionals

Investors and fund advisors

Business consultants & coaches

Marketing agencies & consulting firms

Examples of services that are offered:

Estate planning:

Basic estate planning: wills and revocable trusts

Advanced planning: irrevocable trusts & foundations

Estate size reduction & asset protection

Multi-generational wealth preservation

Tax planning:

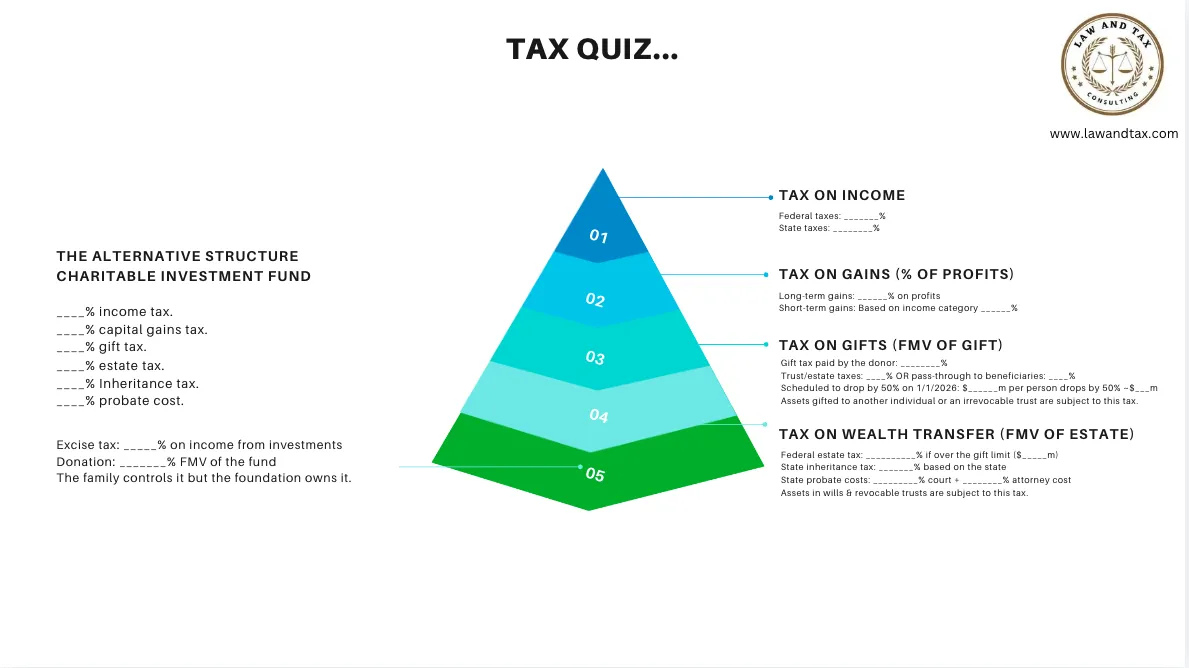

Lowering income tax and capital gains tax

Lowering estate tax, gift tax, and inheritance tax

Avoiding or lowering probate costs & process

Why offer estate & tax consulting services:

Build a new revenue channel solving million-dollar problems for your top clientele

Increase AUM or commission size by reorganizing your client's assets, cash-flow, and tax obligations

Boost revenue per customer (LTV) by offering high-value services that they will need to solve (now or in the future)

Save your clients millions of dollars in taxes and build long-term trust and goodwill - become irreplaceable!

Leverage our resources - training, tools, technologies, and experts ready to help you attract & convert clients

Partner With Us:

Let's Thrive & Help More People Thrive

Press Play To Watch The Presentation

A Quest To Find Money, Freedom, And Purpose...

Round 1: Entrepreneurship: Product based business:

In 2001, I started a bakery, which turned out be a smashing success - 10,000 square foot factory, millions in annual sales, staff of 20 full-time employees, and a fleet of delivery trucks. However, in 2005, the banks withdrew their support, leading to a multi-million dollar bankruptcy that wiped out all my personal assets as well.

This experience put me on a quest to learn the law to avoid future mistakes, and help other entrepreneurs and investors do the same.

A few weeks after my bankruptcy, I secured a job at the Bankruptcy Court and enrolled in several bankruptcy, tax, and restructuring courses, and launched my first legal consulting firm by the end of the year. My consulting firm specialized in Business, Tax, and Bankruptcy Consulting, facilitating asset restructuring, debt and tax reduction, and bankruptcy solutions.

Entrepreneurship: Round 2: Service based business:

I decided to test a different approach this time - let's focus on "The Art of Leverage" in order to eliminate the risks of business ownership - raw material, staff, overhead, bad debt, high-interest loans, and personal risk associated with ownership.

I formed several joint-ventures with law firms, accounting firms, bankruptcy trustees, and financial advisory firms, who were ready to offer their office space, their templates, and their expertise to help me grow my firm. I facilitated the entire process and charged a "consulting fee" for my work, in addition to receiving commissions and referral fees for advanced reorganization work.

The logic behind joint ventures is simple:

Why build a business and incur immense personal risk, when you can split the costs, resources, overhead, marketing efforts, and profits with other established firms - who are ready to do the same! Think of it this way: 20% of a watermelon is still larger than 80% of a grape!

Growth Formula:

I had the opportunity to go bankrupt and restart from scratch - but this time, I had very little risk, had no overhead, had more sources of referrals, and was able to apply the concepts I was offering to clients in my own life as well - it was profitable, purposeful, and provided personal satisfaction knowing I was helping families protect and preserve their hard-earned wealth.

Obsession With Law, Tax, Finance, and Technology:

From 2008 - 2013, I studied law in Canada, the UK, and the US, focusing on Business, Estate, and Tax law, while running my legal and tax consulting firms in a virtual and remote manner in Canada, as a full-time law student in the UK and the US. That's the power of joint ventures - I could tap into a network of professionals who could close the deals, serve clients, and still receive compensation - without being directly involved.

his methodology helped me not only pay-off an immense amount of debt obligations in the bankruptcy proceedings, but also accumulate enough surplus to pay law school fees in full without any loans, and live in two of the most expensive cities in the world - London and Los Angeles, while managing a virtual consulting firm in Toronto.

Since 2013, I've been licensed in California as an attorney and have been engaged in several very fruitful joint ventures that have now aligned roughly 5,000 law, tax, and finance professionals into our network!

Whether our clients (entrepreneurs, investors, high-income earners, and high-net-worth-families) need legal help, tax help, accounting help, financial advise, insurance help, marketing & business strategic help, investment strategies, or anything in between - there's a good chance that we can help the client find the right person for the job - again, that's the power of "joint ventures and strategic alliance" - we do not have to do everything ourselves - it's all about "leverage"!

Collaborate, Not Compete:

We serve entrepreneurs, investors, high-income earners, and those facing significant financial or life-changing events. By joining forces, we can achieve greater results. The joint venture model allows both of us to:

Enhance Client Value: Access to a wide range of experts to help clients.

Differentiate in the Market: Offer advanced solutions for high-net-worth clients.

Attract Premium Clients: Provide specialized estate and tax solutions.

Expand Business: Grow without additional staff or overhead.

Capitalize on Wealth Transfer: Reach more clients through collaboration.

I invite you to watch the presentation below on how to joint venture with us and build an Estate and Tax Consulting Firm - often in as little as 7-days. If our approach and message resonates, schedule a one-on-one session to discuss the joint venture partnership.

Let’s collaborate, share revenue, and help countless entrepreneurs and investors solve multi-million dollar estate and tax problems together!

Thank you,

Sid Peddinti

BA, LLB/JD, LLM

P.S. I’m passionate about educating people on legal and tax strategies. This is our passion and our obsession. Having lost everything once, I’m committed to helping others avoid the same mistakes by sharing practical insights and tips. Below are some of my recent publications and keynotes on law, tax, finance, and philanthropy - the four key areas that we help people with.

Why Start An Estate & Tax Consulting Firm?

We Believe There's An Infinite ROI From Learning And Offering Estate & Tax Consulting Strategies:

Stand-Out From Competitors, Increase The LTV Of Clients, Tap Into A Recession-Proof Marketplace That Is Expanding Every Single Day, Build A Portfolio Of High-End Clients, And Leverage These Strategies To Preserve Your Own Wealth And Lower Millions In Potential Taxes Over The Next Few Decades!

Every client needs estate and tax planning!

Each and every client your business serves will be looking into estate planning and tax strategies at one point or another. Why not monetize the opportunity in front of you by learning the basics of estate and tax planning and add massive value to your clients?

In many cases, the value you can add by pointing clients in the right direction (using other experts and teams) will exceed six or seven figures in total tax reduction and savings for your clients - that's a great way to differentiate yourself from almost all your competitors in the marketplace.

The demand for estate & tax consulting increases every single day.

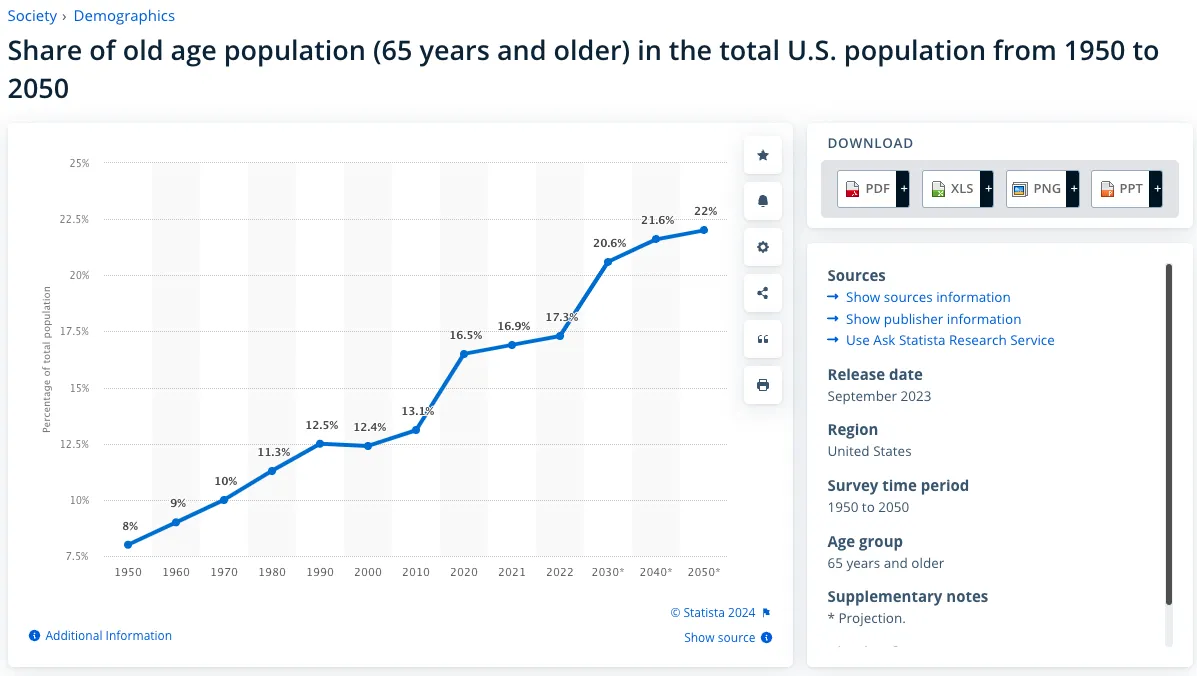

Over 10,000 people a day are turning 65 years old, which means that more people are going to thinking about estate planning and tax strategies - and this number will increase on a daily basis for the next 25 years or so. Read that again to really grasp the opportunity that lays ahead of us!

We are in the midst of the greatest transfer of wealth in human history - somewhere around $85-100 trillion will be changing hands in the next 20-30 years - the time to enter this market is NOW!

Tax rates are going to increase in 2026 - millions are going to be impacted and need us!

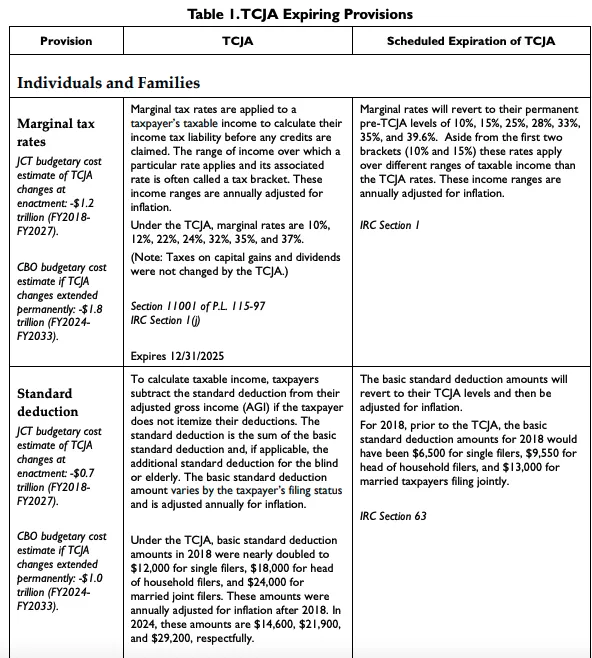

The Tax Cuts & Jobs Act is scheduled to expire on December 31, 2025, which will increase several layers of taxes, including income taxes, estate taxes, and gift taxes. Estate and gift tax is 40% at the highest rate, and federal income tax brackets are schedule to increase to 39.6% (plus state tax).

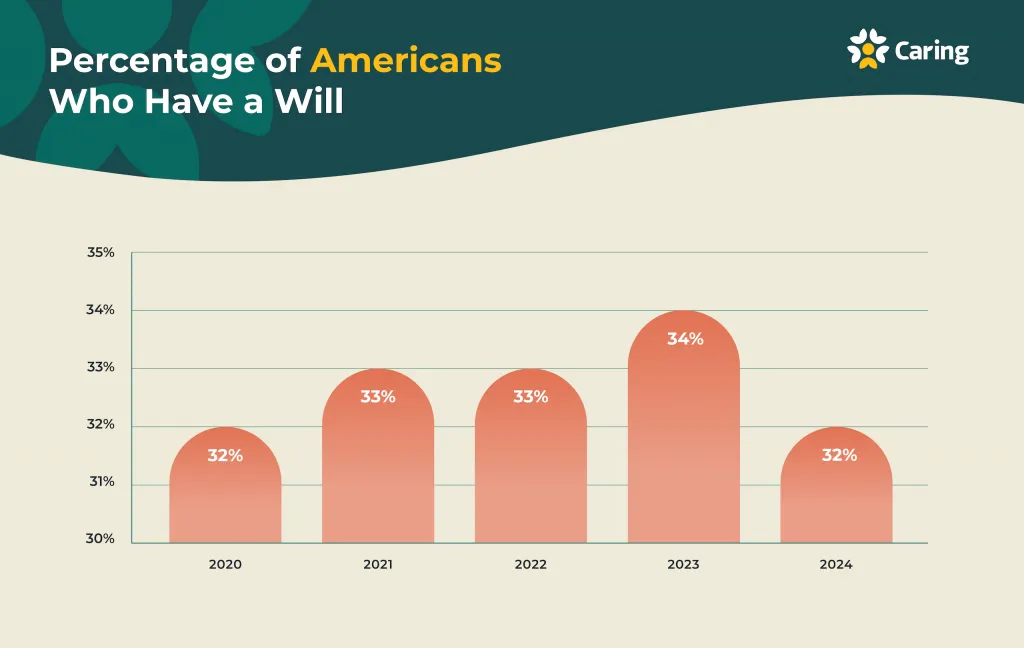

On the other hand, statistics show that less that a third of the population have wills, trusts, or foundations (estate plans) in place! Watch the webinar where we discuss the "impact" the combination of aging population, low percent of estate planning, and the tax rates will have on a sizable percent of the population.

These changes impact you, your family, and your hard-earned money as well.

Estate planning and tax laws impact all of us - not just our clients. At one point or another, all of us have to look into strategies to protect our assets, preserve our legacy, and reduce taxes on multiple fronts.

That's how I entered this area in the first place - due to my own bankruptcy and having lost millions of dollar due to poor legal and financial choices.

The knowledge that you'll gain can benefit you and your family for decades to comes, in addition to saving you six or seven figures in taxes over the course of many years or decades. Learn it, leverage it, and create a business sharing your insights on these topics with others.

What's in it for you & what's in it for us?

Create a new and profitable revenue channel

For you: If you're looking to build a new revenue stream and expand your business, this might be a meaningful and lucrative option that's fairly quick to setup and very lucrative.

For us: This also helps us develop a new revenue stream and a new source of referrals, without having to spend a fortune on advertising for clients that you are already serving or are within your network.

No additional staff required to get started

For you: This is a joint venture model, we already have the experts to handle the paperwork, mentorship, setup the online technology & tools, and service clients through the legal and tax solutions. You can enter a highly lucrative, high-demand, and highly flexible industry without hiring any additional staff to create this revenue stream.

For us: We can expand our business without having to hire lawyers, accountants, paralegal, legal clerks, assistants, or spending a fortune of advertising for new clients. I've already operated a business with a 10,000 square foot factory producing bread and tortillas, with over 20 staff to manage - it went bankrupt. We're looking for sustainable business models and joint venturing has checked all the boxes for close to two decades.

Gain multiple competitive advantages over competitors

For you: From standing-out in your marketplace, to penetrating the market from diverse marketing angles, to gaining a first-mover advantage by mastering strategies that your clients will inevitably look into - you can really distinguish your business and add massive value to clients.

For us: We are looking for all the same competitive advantages that you are looking to gain in your business, and have been able to gain them again and again in different legal niches, in different cities and countries, by truly embracing the power of "teamwork". We want to establish the largest network of "professionals" in this space and believe joint ventures can help us accomplish that.

Earn more revenue per customer (boost LTV)

For you: More problems solved means more revenue in the door for your firm (revenue per case or assets under management, etc.). And naturally, the bigger the problems solved, the larger the commissions, consulting or referral fees. Advanced estate and tax strategies that you'll learn and offer to clients allow us (together) to solve six, seven, and eight figure problems that clients and customers either face right now, or will face in the upcoming years as tax rates spike up. Build a boutique estate and tax consulting firm by learning and integrating startegies used by billionaires: gifting & donating to trusts and foundations.

For us: With your help, we'll be able to serve more customers, and bring in more revenue as well. The way we look at it - it's better to have 20% of a watermelon, than 80% of a grape - it's just that simple!

Create longer engagement and retention cycles

For you: Clients who hire legal and tax firms to help implement these strategies typically stay for very long periods, years together, if not decades together, with the same firm. It's about constantly offering value and making your firm hard to replace - these "bolt-on" legal and tax strategies might give you that competitive edge to keep the best clients in your active client list for years, if not decades.

For us: We are able to repurpose our resources towards research, training, and technologies, instead of marketing, payroll, or overhead. This allows us to constantly create the best educational guides and programs that can assist clients in ways that competitors are unable to offer: both training materials, educational content, insights and updates, as well as mentorship and servicing.

Operate a flexible, easy-to-manage, and virtual business

For you: We have repurposed a ton of our resources into technology and systems so we can literally launch a new law and tax consulting firm with a new joint venture partner, like you, in as little as 7-days. We have developed the training material, the educational content, client presentations, and the technology systems that allow you to learn the basics, facilitate conversations around these topics, and have an online website to capture, convert, and close deals for your new Estate & Tax Consulting Firm™.

For us: If we can "clone" our business and train people to run and manage it (like a franchise) - why would we want to hire a ton of people and incur immense overhead to accomplish the same monetary and impact goals - This joint-venture model benefits both of us!

Leverage these estate & tax strategies to protect your assets and save millions in taxes

For you: The strategies that you'll get trained on are practical estate and tax strategies that you can deploy in your own life. Learn how to "gift and donate" strategically with trusts and foundation, like Billionaires - the strategies you'll learn might be just as relevant to you as they are to your clients.

For us: You might be an ideal client or customer - a successful, savvy professional, who might be looking to master your own "estate and tax" questions. We would love to serve you and help you, and possibly making YOU a "case study" that inspires a ton of other professionals to join our movement. Of course, for joint venture partners, we have highly favorable pricing options for advanced estate & tax solutions.

Create a win-win situation on many levels by partnering with us

- You get to learn the skills that protect your estate and reduce taxes

- We get a new client who not only uses these strategies, but now promotes them to others (you)!

- Our heirs benefit when we can teach and pass on essential "life, death, and taxes" knowledge

- Clients benefit by gaining access to solutions that they're missing out on but ought to be using

- The government has more people reducing taxes without sneaky & shady loopholes and scams

- Nonprofit causes receive more donations from successful people, like us, and our clients

- Society benefits when more people dedicate their income and assets towards charitable causes

Schedule A Call To Discuss The Joint Venture Options And How To Bolt-On An Estate & Tax Consulting Firm In As Little As 7-Days

Copyrighted Material © All Rights Reserved. 2024.

Estate & Tax Consulting™

IMPORTANT: EARNINGS AND INCOME DISCLAIMER

The testimonials showcased on this page are authentic accounts from our clients. However, the outcomes depicted here are not typical and should not be construed as guarantees. Your personal results may differ depending on factors such as your skills, experience, level of motivation, and other unpredictable variables. Our company has not conducted comprehensive studies on the results of our average clients. Therefore, your outcomes may vary.